Each time a property is transferred from one person (physical or legal) to another, the transaction attracts an Impuesto Sobre Transmisión de Patrimonio (I.T.P.). Or, in English, Tax on the Transfer of Wealth.

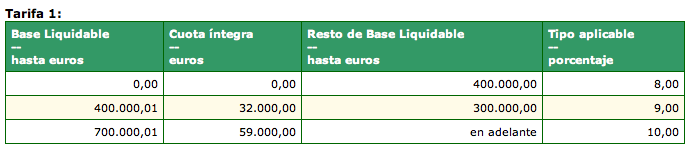

This tax is payable by the buyer and is levied by the Autonomous Region level of government. In the case of Andalucia it is the Junta de Andalucia who levies it. On 31st December 2011, when everyone was out celebrating the coming of the New Year, the Junta quietly raised the level of taxation, in particular for more expensive properties. Current rates are shown in the table below:

The tax is levied on the declared purchase price, i.e. the price set out in the escritura (title deed).

Here are two examples of the tax payable:

Example One: Cortijo sold at €159.000. Tax at 8% x €159.000 = €12.720.

Example Two: Finca sold at €880.000. Tax at 8% x €400.000 + 9% x €300.000 + 10% x €180.000 = €77.000 (an average of 8.75%).

There is a legitimate way to reduce at least some of this tax!